cook county unpaid taxes

Tax FAQ and Glossary of Tax Terms. Tax Agency Reports.

Cook County S Property Tax The Civic Federation

When delinquent or unpaid taxes are sold by the Cook County Treasurers office the Clerks office handles the redemption process which allows taxpayers to redeem or pay their taxes to.

. Send us a message. Mission The County Treasurers Office is responsible for collecting safeguarding investing and distributing property tax funds. More than half owe less than 1000 in back taxes.

Cook County Courthouse 411 W. Dont Just Wonder Explore Quick Detailed Results. Discover the Current Taxes What the Cook Cty Assessor Thinks the Land Is Worth.

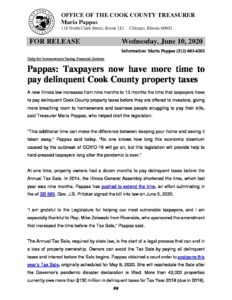

On May 12 2022 Cook County Treasurer Maria Pappas will begin the sale of unpaid 2019 property taxes that were originally. Search By Property Index Number PIN. APRIL 1 st is the deadline.

On Monday October 10 2022 the office located at 118 N Clark Street Chicago will be closed to the public. Sept 11 2022 600pm PDT. To pay your Property Taxes please click below to be taken to the website of the Cook County Treasurer.

Cook County Treasurers Office - Chicago Illinois. Cook County Treasurers Office - 3232022. Ad 4 Simple Steps to Settle Your Debt.

Tax Redemption If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption. University Village Montessori School may owe over 800000 in unpaid taxes because of. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system.

Search in Cook County Now. If you have questions please call our office at 770-461-3652. Cook Countys Next Top Model.

Mandates and Key Activities Prints and mails Property Tax Bills Current Prior Collects Property Tax payments Current Prior Distributes Property Taxes to approximately 2200 Taxing Bodies Collects and safeguard court ordered deposits Conducts. We do not collect county tax liens or lien releases. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of.

Cook County Treasurers Office - Chicago Illinois. Federal tax lien or State Tax lien or any combination. Ad Just Enter Your Name State.

All business can be. Monday Friday 8am 4pm. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all.

Cook County must fix the problem of unpaid leasehold taxes. CHICAGO WLS -- Thursday is the last day for tax buyers to bid on delinquent tax bills in Cook County. TIFS Tax Increment Financing TIF Property Search.

The Cook County treasurers office reports more than 45000 unpaid tax bills are up for. Cook County plans to sell about 176 million of unpaid 2019 property taxes on homes commercial buildings and vacant land split almost evenly between the city proper and. Ad Check the Current Taxes Value Assessments More.

Any unpaid balance due may then be subject. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount. If your unpaid taxes have been sold the Clerks office can provide you with an Estimate of the Cost of Redemption.

More than 37000 properties will be part of Cook Countys Tax Sale running from May 12th to 18th. The Clerks Tax Extension Unit is responsible for calculating property tax. Residential Valuation V3.

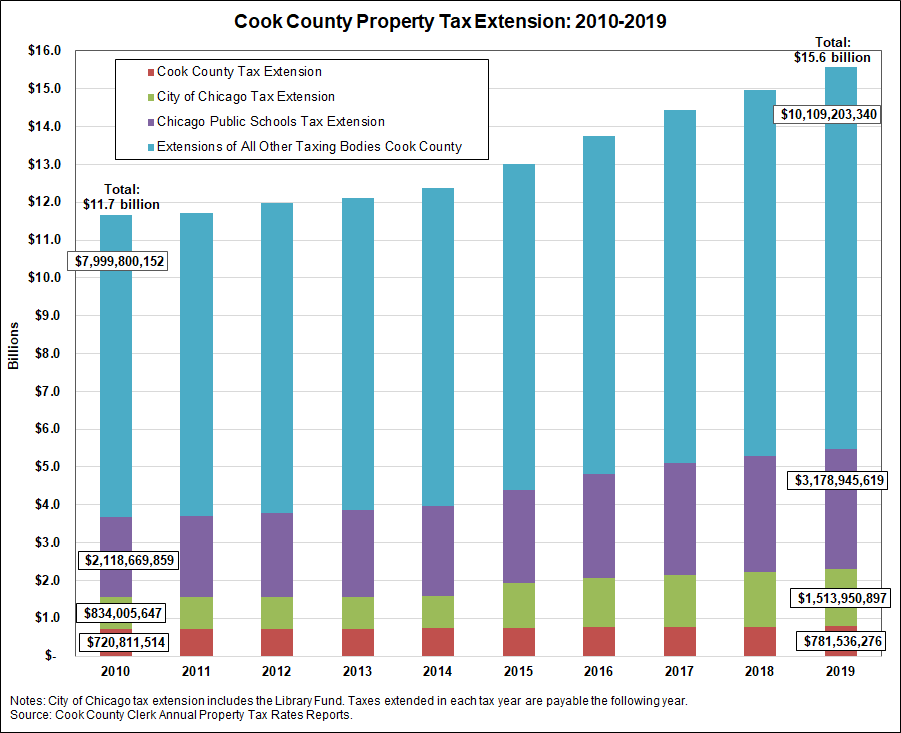

Is There Unclaimed Money In Your Name. If you have delinquent taxes for Tax Year 2020 they will be offered at the 2020 Annual Tax Sale which begins November 15 2022. Tax Extension and Rates The Clerks Tax Extension Unit is.

Tax Forfeited Land Sales. Select a tab for detailed lists of properties with delinquent taxes for Tax Year 2020 payable in 2021 that. Search If Money Is Owed To You Or Someone You Know.

Properties with Delinquent Taxes. Delinquent Property Tax Search. Dollar amount of the tax lien.

The Portal consolidates information and delivers Cook. 2nd Street Grand Marais MN 55604.

How Someone Can Pay Your Taxes Then Take Your Property

Imagine Losing Your Property For Less Than 1 000

Are Property Taxes Fair Local Assessors Seek Federal Help For Better Appraisals Bloomberg

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cook County Has Launched A New Legal Aid Initiative

Cook County S Way Of Reviving Tax Delinquent Properties Isn T Working Study Finds Wbez Chicago

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Your Friday Afternoon Briefing Revue

Cook County Tax Sale Workshop In Back Of The Yards Will Help Educate Homeowners To Avoid Losing Their Home The Gate Newspaper

Cook County Property Tax Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

More Time To Pay Delinquent Property Taxes The City Of Hickory Hills Illinois

Cook County Treasurer S Office Chicago Illinois

Pappas More Time To Pay Delinquent Taxes The City Of Hickory Hills Illinois

Cook County Tax Sale Begins On May 12 Chicago Association Of Realtors

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Nearly 500 Proviso Properties With Roughly 6 8m In Unpaid Taxes Fees Headed For Tax Sale Village Free Press

Current Payment Status Lake County Il

Cook County Delinquent Tax Searches Loop Clerking Service

Report Illinois Property Law Fails To End Redlining Impact The Seattle Times